By Andrew Edsall

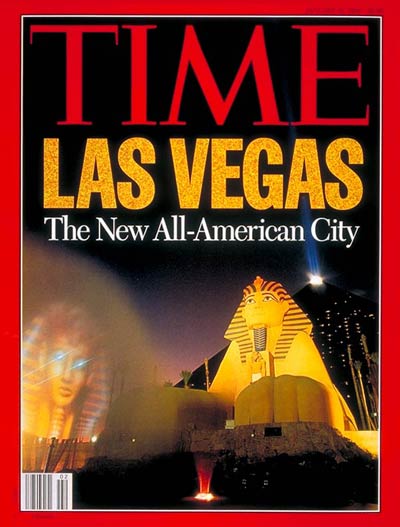

Growing up, I remember reading in Time Magazine about how Vegas was going to become family-friendly in the mid-90s by building shopping areas, attractions like indoor theme parks and shows, and convention space. This is what evolved into an integrated resort: a large resort that includes a hotel with a casino, convention facilities, entertainment shows, theme parks, luxury retail, and fine dining. The weekday conferences and events attracted business travelers, who were able to even out the cyclic weekend peaks and weekday valleys. The shopping and other attractions bring families on holidays and weekends. Now, integrated resorts are coming to Japan.

What happens in Vegas no longer stays in Vegas – Integrated resorts are coming to Japan

The model, known as integrated resorts, has been replicated around the world, including the United States, Singapore, Macau. At the same time, other U.S. states and jurisdictions, such as tribal lands, have approved their own gambling laws. Vegas is no longer the sole dominator in the western states. According to a 2018 Las Vegas Review-Journal interview with Bob Boughner, Senior Partner at Global Market Advisors (GMA), a gaming and hospitality consultancy, and former president and CEO of the Borgata in Atlantic City, non-gaming is responsible for between 45% to 75% of revenue in Las Vegas. Just as Vegas has changed, Japan is going through its own changes. The Reiwa Era (2019~present) will bear witness to a traditional society being forced to modernity by unparalleled demographic pressures.In Japan, change is inevitable

According to the Statistics Bureau of Japan, Japan’s population has already peaked at 128.1 million in 2008 and has already declined to 124.8 million (June 11, 2019), which includes nearly 30% of the population being over 65 years old. Due to the number of deaths outnumbering births, Japan’s population is decreasing approximately 430,000 people annually. This number is only expected to increase. Nothing, not even immigration, will stop this trend. With an aging population and fewer people in the workforce, Japan will serve as a Petri dish regarding aging. Changes are already being seen in:- The changing world of work

- Women power

- Generational dynamics

- Internationalization

After nearly 20 years of debate and on-and-off discussions, the Japanese Government has agreed to initially permit three integrated resorts. These massive facilities will have exhibition space and conference rooms bigger than Tokyo Big Sight. Over 2500 hotel rooms, which will be more in line with Western size hotels (not closet-like rooms), will greet guests from around the world. World-class shopping and restaurants, theaters and cinemas will offer diversions. New transportation systems will move visitors and employees efficiently. Cultural venues that will highlight the best of Japan. Finally, a casino that will be limited to 3% of the area and with limited access.

Where does Japan go from here?

The timing is up in the air, as the operating frameworks are still being considered and expected to be announced later in 2019. The operator and site selection process will take upwards of a year, and then planning and construction would be 3-5 years, the doors would most likely open to the public around 2025 or later.Here are the rules for integrated resorts & casinos in Japan

The government has reviewed what works around the world and crafted a strict set of rules regarding the integrated resort operations and the casino. Residents of Japan will be limited to the number of times they can visit the casino per month, and they will need to pay an entrance fee of 6000 yen, which will be split between the local and national governments. Among gaming industry consultants, some feel that while the restrictions may be too strict initially, they can be dialed back. Having to make the rules stronger after opening is quite difficult and would have its own consequences. Naturally, there are no limits on non-gaming activities such as shopping, restaurants, or entertainment. Now comes the hard part, getting the customers on board. By gender, males are the key constituents to partake in gaming activities – they are twice as likely as women to engage in some form, whether it be pachinko, racing (horse, bicycle, boat), sports betting, etc.How do Japanese people feel about casinos?

From our April 2019 Sentiment Survey, we have found that one in four are excited about the leisure and economic opportunities that the IR present and one in three are in the Kansai region. Young males, aged 16-29 are the most excited. However, women are a much tougher audience. While women are not the key demographic for gaming, they often control the household finances. To be successful and sustainable long term, the IR needs to understand and respond to the changing power dynamics of generation and gender. The non-gaming aspects need to have the shopping, culinary, cultural, and entertainment that appeal to women. And if they want to visit the casino, they must be welcoming – not pandering.“The Japanese customer is king”

From our market research work in entertainment, luxury, hospitality, fine dining, and retail, we are aware of the importance of customer segmentation. From our qualitative work, such as focus groups and ethnography, we have found that to win the battle of hearts and minds, especially at a site as diverse as an IR, operators must aware, recognize, and deliver an excellent customer experience. I am not referring to omotenashi. I have traveled throughout Japan over the past few months, and have witnessed some shockingly poor customer service in regional hotels. From inflexibility regarding early check-in to experiencing the first interaction be, “Can you speak Japanese?” These attitudes will not fly in an IR, especially if the IR wants to cater to foreign tourists.The importance of tourism to Japan

A lot has changed since I first came to Tokyo in 1997. Thanks to a streamlined visa process and an increase in the number of international flights. According to JNTO statistics, the number of tourists has increased from 4.1 million in 1997 to nearly 32 million per year, with nearly 70% of these coming from Asia. An integrated resort, especially one that highlights cultural aspects, tours to regional landmarks, premium dining and entertainment, and a little fun in the casino is sure to land on travel itineraries.What would a Japan integrated resort look like?

With three licenses up for grabs, casino operators like Las Vegas Sands, MGM Resorts, Melco Resorts, and Group Lucien Barriere have been looking for local consortium partners and host cities. I think that a successful IR here would not overly play up the Japan connection. I do not want to see images of Mt Fuji, tatami rooms, and ninja everywhere. That might work for tourists, but the locals expect something classier.

Normal Japanese want to escape their normal lives. This is one reason why theme parks like Sanrio Puroland (aka Hello Kitty Land), the recently opened Moomin Valley, Tokyo Disneyland, and Universal Studios Japan do well. The average Japanese has few chances to travel to exotic locales like Las Vegas, Monte Carlo, or Singapore. A successful IR would bring the dynamic elements of overseas travel closer to home. It would also provide a safer, more familiar environment. Through effective research, marketing, and operations, integrated resorts would be an economic powerhouse and create tens of thousands of jobs in Japan. This opportunity would change the world of work and provide new opportunities for women and aging workers. It would also require additional staff from overseas. These employees would be vital to creating a venue where people can meet, eat, shop, and have fun.